nj bait tax example

Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. If the sum of each members.

Nj Bait Election Video Tutorial Youtube

The concerns of passthrough.

. In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT. So on the federal side we have the 275000 of distributive proceeds. Good News in New Jersey.

This change does not affect TY 2020. Signed into law in January the BAIT is a new elective. The owners then receive a proportionate credit on their New Jersey gross income tax liability.

Each has 50 ownership interest and the partnership earns taxable. 10 Californias top individual tax rate is 133 consisting of 123 of regular tax and an additional 1 for incomes. Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax. The tax rates for NJ BAIT range from 5675 to. NJ Business Alternative Income Tax BAIT Law Change.

Pass-Through Business Alternative Income Tax Act. September 3 2021. The Tax Cuts Jobs Act of 2017 drastically limited the federal deduction for state local taxes to 10000 for.

Two NJ residents own an eligible partnership. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax. To explain how NJ BAIT works we will give you an example.

Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law. NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to. PL2019 c320 enacted the Pass-Through.

This change does not affect TY 2020. The BAIT is intended to give NJ individual income taxpayers a work-around of the. Pass-Through Business Alternative Income Tax Act.

In Californias initial PTE tax proposal no tax rate was listed. This legislation generated only passing interest from the taxpaying. The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year.

In January 2020 New Jersey enacted the Pass-Through Business Alternative Income Tax BAIT. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the. The purpose of this guidance is to provide answers and clarification to commonly asked questions regarding PL2019 c320 C54A12-1 et al and PL.

The TCJA imposed a 10000 limitation on the amount of state and local tax SALT that individuals or pass-through business owners may deduct for federal income tax. In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT. The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal.

New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT.

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Explainer Decoding Nj S Budget Babble A Dictionary Of Useful Terms Nj Spotlight News

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Unnecessary Delay Or Due Diligence No N J Companies Have Received Tax Awards Due From 2018 Eda S Sullivan Says State Has Just Increased Vetting Roi Nj

New Jersey Passes Bill To Correct Issues Arising From The Implementation Of The Nj Business Alternative Income Tax Marcum Llp Accountants And Advisors

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

How Much Time Do I Have Left To Make The Ptet Election

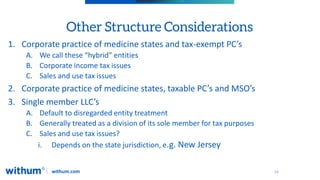

New Jersey State Tax Updates Withum

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

Withum Healthcare Tax Update 2022

New Jersey Partnership Tax Login

Partnerships And S Corporations Exempted From Limits On State And Local Tax Deduction

Complexities Abound For Pass Through Entities And Salt Deduction Work Arounds

Nj Division Of Taxation Nj 1040 And Nj 1041 E File Mandate Faq

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors